A Vindictive Class War: Analysis and rebuttal of Reeves' 2024 Budget

British voters who were historically not loyal to Labour, were punished.

Headline message: The Budget’s attack on SMEs, farmers, pensioners, bus travel, and private schools sacrificed economic growth for a counter-productive and brazen act of class war - targeting voters who were historically not loyal to the Labour Party.

1 Budget Overview: Highest ever tax burden, and a bogus story.

Glass-ceiling? Rachel Reeves’ October 2024 Budget was the first in British history to be presented by a woman Chancellor of the Exchequer; what other firsts did she set?1

Tax Burden: This Labour Budget will take the country’s tax burden to the “highest level on record”, projected to hit 38.3% of GDP by 2027-28.23

£40 Billion tax rise: the headline for this budget is the £40 Billion tax rise, levied across Britain - making it the largest tax rise in over 30 years - since 1993.4

“Black Hole”: The Chancellor argues a range of new taxes and austerity measures are necessary to (1) fill the alleged ‘£22 Billion Black Hole’ left by the last Tory Government, and (2) “fund our public services”.5

False Claims: Writing to the Treasury Select Committee, Richard Hughes (Chair, Office for Budget Responsibility) was unable to “substantiate the Chancellor’s £22 billion claim”, pointing to £9.5 billion of undeclared spending instead.6

Historic Dishonesty: The Chancellor’s budget appears as trustworthy as her doctored CV.7 This Budget is a story of broken manifesto promises and a vindictive class war - punishing British voters, who did not historically vote Labour.

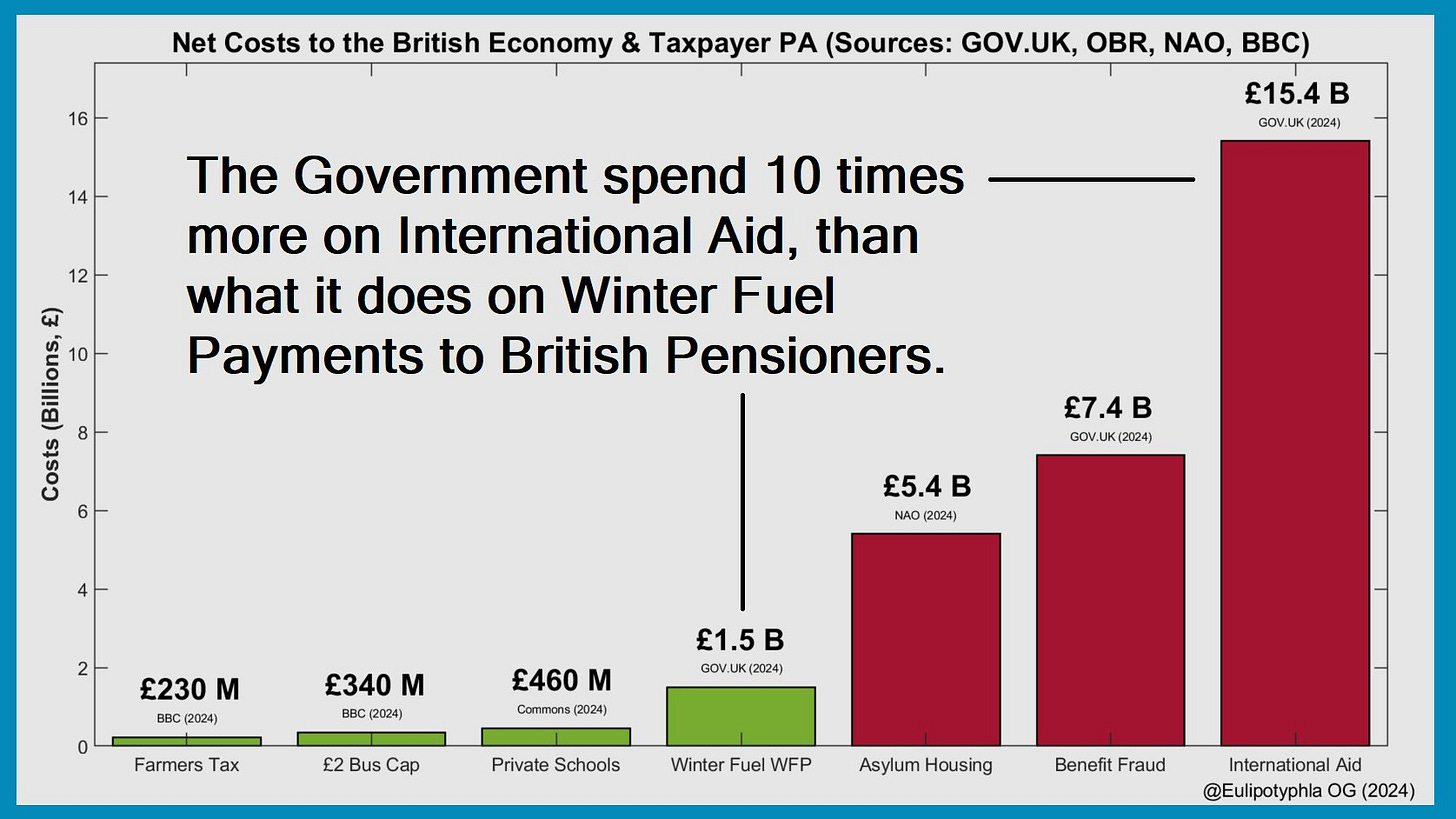

Foreign Priorities: Labour Budget chose to spent six times more on the International Aid budget (£15.4 Billion), and double on the Asylum budget (£5.4 Billion), than the total revenue raised (£2.53 Billion), from attacking farmers, bus travel, private schools, and pensioners’ Winter Fuel Payments.89 (It was never about “our public services”.)

2 Labour Budget vs Manifesto: Broken Promises and Weasel Words

Tax Burden: “The Conservatives have raised the tax burden to a 70-year high. We will ensure taxes on working people are kept as low as possible.”, Labour Manifesto 2024.10

National Insurance: “Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT.”, Labour Manifesto 2024.13

Bus Travel: “Local communities have lost control over their bus routes. Fares have increased, routes have disappeared, and services are unreliable.”, Labour Manifesto 2024.16

Pensioner Poverty: “The last Labour government lifted over half a million children and over a million pensioners out of poverty. The next Labour government will build on that legacy…”, Labour Manifesto 2024.19

Farmers’ Tax: “Supporting British farmers - Labour recognises that food security is national security. That is why we will champion British farming…”, Labour Manifesto 2024.22

Private Schools VAT: “Recruit 6,500 new teachers in key subjects to prepare children for life, work and the future, paid for by ending tax breaks for private schools.”, Labour Manifesto 2024.26

The new application of VAT on private schools, is ostensibly the only act of class war in this Budget that the manifesto did promise. (Taxing education is illegal in the rest of Europe, mind you.) It is already a double tax on parents, who already contribute to state education; unlike Britain, Germany provides private school parents a 5,000 Euro tax rebate.27

The Centre also anticipates that the ‘6,500 new teachers’ promise is a likely lie. The Private Schools VAT is going to raise only £460 million in 2025/26.28 (This all assumes parents do not take their children out of the system… doubtful.)

The German and French Ambassadors have warned that Labour’s post-Brexit “reset” in relations will be ‘imperiled’, if the Government pushes ahead with this tax on their countries’ international schools in Britain.29 (No noise from the FBPE crowd?)

A sorry tale: There is no question that this Budget —resulting in a record high tax burden and multiple broken promises to the electorate— amount to anything less than a vindictive class war against British voters disloyal to the Labour Party.

3 Question of Scale: Our public services or someone else’s?

Headline: The total revenue and savings (£2.53 B) made from the Farmers’ Tax, Private Schools VAT, the removal of the £2 Bus Fare Cap, and universal coverage for pensioners’ Winter Fuel Payments ending, amount to LESS than half of annual spending on asylum claimants (£5.4 B - from food to accommodation) in Britain in 2024.30

Budget Day: “Any responsible Chancellor would need to take difficult decisions today, to raise the revenues required to fund our public services”, Rachel Reeves told Parliament.31 Comparing the difficult decisions versus the spending choices, it is clear that those decisions were maliciously taken, and not for our public services.

Winter Fuel Payments vs International Aid: The cost of keeping all our pensioners warm (£1.5 B), is less than ten times the amount that Britain spends on international aid (£15.4 B).32 Yet, this Labour Budget chose to raise spending abroad, whilst telling to the electorate to “fund our public services”.

Farmers’ Tax vs Asylum Claimants: When BBC’s Victoria Derbyshire asked TV star (and farmer) Jeremy Clarkson how else will the Government fund our public services, the answer should be been: Britain spends 23 times more on asylum claimants this year (£15.4 B), than what the new Farmers’ Tax will raise next year (£230 M).33

£2 Bus Fare Cap vs Net Zero Spending: The projected overall cost of Net Zero Carbon policies across 2020 to 2050 will come to £321 Billion - averaging at £10.7 Billion per year.34 In comparison to Net Zero spending (and associated waste), subsidised bus travel across the country with the £2 fare cap, costed a paltry £340 Million - less than 1/45th of annual Net Zero spending.

Private Schools VAT vs almost anything else: In 2024, the projected revenue from taxing Private Schools (£460 Million) amount to 0.4% of the Government’s total spending on Education (£116 Billion).35 It is such a negligible sum that this revenue would make up less than one 14th of annual benefit fraud (£7.4 Billion).36

4 Budget Commentary - from Think Tanks and Industry.

“As a consequence of higher interest rates, real wage adjustments, and capacity and skilled worker constraints, there is also some further crowding out of business investment, consumption, and net trade”, Office for Budget Responsibility.37

“The budget was a non-event and kicked big decisions down the road”, Paul Johnson (Director), Institute for Fiscal Studies.38 (Adding: “Ms Reeves may be overegging the £22 billion black hole.”)39

“Expect significant negative impacts on employment and wage growth, especially in low-paid sectors such as hospitality”, Dr Eliza da Silva Gomes (Economist), National Institute of Economic and Social Research.40

“A woman Chancellor, but not a budget for women”, Jill Rutter (Senior Fellow), UK in a Changing Europe - Kings' College London.41

“Increases to the employer cost base will increase the burden on business and hit the ability to invest and ultimately make it more expensive to hire people or give pay rises”, Rain Newton-Smith (CEO), Confederation of British Industries.42

“The immediate outlook for real pay is far from rosy and, after this Budget, has worsened.. There are particular concerns about what this stagnation of average living standards could be concealing for many vulnerable families at the bottom of the scale”, James Smith (Research Director), Resolution Foundation.43

“Growth will flatline over the next five years”, John O’Connell (CEO), Taxpayers Alliance.44

5 Political Implications - how should the Right respond?

The political choices of targeting SMEs, farming, bus travel, pensioner’s winter fuel payments, and private schools must be communicated to the public for what it is: a new Chancellor, Rachel Reeves sacrificing growth, for a counter-productive and brazen act of class war against voters historically hostile to Labour.

The clumsy responses from right-aligned actors, including a completely under-prepared Jeremy Clarkson taking a BBC interview at the November Farmers Protests, is no longer an acceptable state of affairs. Even basic preparation of 3-4 points, with a few statistics painting the injustice, would have been net-positive.

The passing of this Labour Budget is the culmination of 14 years of Tory failure, a disillusioned electorate, and a splintered Right. A Conservative Opposition reduced to 120 seats is a 5-year blank cheque for the Government to pass whatever they wish, with no fear of losing a Parliamentary division.

It is not entirely clear that any other Labour Government would have been as brazen with its Budget. All Right-adjacent politicians and commentators ought to reflect on its real and consistent failure to defend its own voters and interests, as well as its unserious/cavalier attitude to power.

In the run up to 2024 General Election, the common ‘zero-seats’ refrain reflected a desire from the Right to punish the Tories, and a flippant sentiment that whoever in power from the ‘uniparty’ would not affect outcomes for people. This Labour Budget is a timely reminder of how things can always be worse.

Beyond fiscal policies designed to social engineering the country against the Right’s core voters, if Labour moves ahead on non-citizen voting, and like this with this Budget, with various other permanently damaging changes to Britain, the Right will have its work truly cut out for them in 2029.

6 References

Rutter, J. (2024). A woman Chancellor, but not a budget for women. [online] UK in a changing Europe. Available at: https://archive.ph/4NfQi [Accessed 1 Nov. 2024].

Swinford, S., Wright, O. and Smyth, C. (2024). Record tax burden will stall growth, warns OBR. [online] TheTimes.com. Available at: https://archive.ph/tLSot [Accessed 1 Nov. 2024].

Hazell, W. (2024). Tax burden set to rise to highest level ever after Budget - here’s why. [online] inews.co.uk. Available at: https://archive.ph/KwERE [Accessed 1 Nov. 2024].

Reeves, R. (2024). Autumn Budget 2024 speech. [online] GOV.UK. Available at: https://archive.ph/F6AbS [Accessed 1 Nov. 2024].

Ibid.

Hughes, R. (2024). Letter from Richard Hughes to Dame Meg Hillier MP on the OBR review of the March 2024 forecast for departmental expenditure limits, 30 October. [Letter]. Office for Budget Responsibility. Available from: https://archive.ph/DOJl9 [Accessed 1 Nov. 2024].

Bullivant, C. (2024). Rachel Reeves Under Fire as CV Claims Exposed – Former Colleagues Say She Lied About Role as ‘Economist’. [online] Conservative Post. Available at: https://archive.ph/2TYiy [Accessed 1 Nov. 2024].

Foreign, Commonwealth, and Development Office. (2024). Statistics on International Development: provisional UK aid spend 2023. [online] GOV.UK. Available at: https://www.gov.uk/government/statistics/statistics-on-international-development-provisional-uk-aid-spend-2023/statistics-on-international-development-provisional-uk-aid-spend-2023 [Accessed 1 Nov. 2024].

National Audit Office. (2024). An Overview of the Home Office for the New Parliament 2023-24. Available at: https://www.nao.org.uk/wp-content/uploads/2024/10/home-office-overview-2023-24.pdf [Accessed 1 Nov. 2024].

Starmer, K. (2024). Change. [online] The Labour Party. Available at: https://labour.org.uk/change/ [Accessed 1 Nov. 2024].

Full Fact. (2024). What’s happening to the ‘tax burden’? - Full Fact. [online] Available at: https://fullfact.org/election-2024/tax-burden-labour-conservatives-election-briefing/ [Accessed 1 Nov. 2024].

Hughes, D. (2024). Taxes, borrowing and spending up in Rachel Reeves’ first Budget. [online] The Standard. Available at: https://www.standard.co.uk/business/money/taxes-borrowing-and-spending-up-in-rachel-reeves-first-budget-b1191043.html [Accessed 1 Nov. 2024].

Ibid 10.

Ibid 4.

Newton-Smith, Rain. (2024). CBI responds to Autumn Budget 2024 | CBI. [online] Available at: https://www.cbi.org.uk/media-centre/articles/cbi-responds-to-autumn-budget-2024/ [Accessed 1 Nov. 2024].

Ibid 10.

Edwards, C. (2024). Bus fares to soar if £2 cap axed, says transport boss. BBC News. [online] 28 Oct. Available at: https://www.bbc.co.uk/news/articles/cdrd0j44m4yo [Accessed 1 Nov. 2024].

Ibid

Ibid 10.

Social Security Advisory Committee (2024). The Social Fund Winter Fuel Payments Regulations 2024: letter to the Secretary of State for Work and Pensions. [online] GOV.UK. Available at: https://www.gov.uk/government/publications/the-social-fund-winter-fuel-payments-regulations-2024/the-social-fund-winter-fuel-payments-regulations-2024-letter-to-the-secretary-of-state-for-work-and-pensions. [Accessed 1 Nov. 2024].

Stacey, K., Butler, P. and Brooks, L. (2024). Winter fuel payment cuts may force 100,000 pensioners ‘below poverty line’. [online] the Guardian. Available at: https://www.theguardian.com/society/2024/nov/19/winter-fuel-payment-cuts-may-force-100000-pensioners-below-poverty-line.

Ibid 10.

Prior, M. (2024). Farmers ‘betrayed’ by Labour’s £1m inheritance tax relief limit. BBC News. [online] 30 Oct. Available at: https://www.bbc.co.uk/news/articles/c1ml5zm9lz5o.

Nfuonline.com. (2024). An impact analysis of APR reforms on commercial family farms. [online] Available at: https://www.nfuonline.com/updates-and-information/an-impact-analysis-of-apr-reforms-on-commercial-family-farms/.

Williams, L. (2024). Jeremy Clarkson rips into BBC for acting as ‘Labour mouthpiece’ in furious farming protest speech. [online] GB News. Available at: https://www.gbnews.com/celebrity/jeremy-clarkson-farmers-protest-bbc-mouthpiece-speech [Accessed 19 Nov. 2024].

Ibid 10.

Familienportal.nrw. (2024). How parents deduct school fees from their taxes - FAMILIENPORTAL.NRW. [online] Available at: https://www.familienportal.nrw/en/6-bis-10-jahre/finanzielles-formales/tuition [Accessed 1 Nov. 2024].

McGough, K. and Clarke, V. (2024). Private schools proceed with legal action over VAT plans. BBC News. [online] 31 Oct. Available at: https://www.bbc.co.uk/news/articles/c98d3xr0290o [Accessed 1 Nov. 2024].

Keate, N. (2024). Brexit row erupts over UK tax on private schools. [online] POLITICO. Available at: https://www.politico.eu/article/brexit-battle-over-uk-tax-private-schools-germany-france-ambassadors-vat-labour-miguel-berger-helene-duchene/ [Accessed 1 Nov. 2024].

Ibid 9.

Ibid 4.

Ibid 8.

Kovacevic, T. (2024). How many farms would be affected by Budget changes? BBC News. [online] 1 Nov. Available at: https://www.bbc.co.uk/news/articles/c8rlk0d2vk2o [Accessed 1 Nov. 2024].

Office for Budget Responsibility. (2021). Fiscal risks report – July 2021. [online] Available at: https://obr.uk/frs/fiscal-risks-report-july-2021/ [Accessed 1 Nov. 2024].

Institute for Fiscal Studies. (2024). Education spending - introduction. [online] Available at: https://ifs.org.uk/education-spending/education-spending-introduction [Accessed 1 Nov. 2024].

Department for Work and Pensions (2024). Fraud and error in the benefit system, Financial Year Ending (FYE) 2024. [online] Available at: https://www.gov.uk/government/statistics/fraud-and-error-in-the-benefit-system-financial-year-2023-to-2024-estimates/fraud-and-error-in-the-benefit-system-financial-year-ending-fye-2024 [Accessed 1 Nov. 2024].

Office for Budget Responsibility. (2024). The economic effect of policy measures - Office for Budget Responsibility. [online] Available at: https://obr.uk/box/the-economic-effect-of-policy-measures-2/ [Accessed 1 Nov. 2024].

Institute for Fiscal Studies. (2024). The budget was a non-event and kicked big decisions down the road | Institute for Fiscal Studies. [online] Available at: https://ifs.org.uk/articles/budget-was-non-event-and-kicked-big-decisions-down-road [Accessed 1 Nov. 2024].

Edgington, T. and Reuben, A. (2024). Is there a £22bn ‘black hole’ in the UK’s public finances?. BBC News. [online] 3 Sep. Available at: https://www.bbc.co.uk/news/articles/cx2e12j4gz0o [Accessed 1 Nov. 2024].

Da Silva Gomes, Eliza., et al. (2024). Response to the Autumn 2024 Budget - NIESR. [online] NIESR. Available at: https://niesr.ac.uk/publications/response-autumn-2024-budget?type=budget-fiscal-event-comment [Accessed 1 Nov. 2024].

Ibid 1.

Ibid 15.

Smith, J., et al. (2024). More, more, more • Resolution Foundation. [online] Available at: https://www.resolutionfoundation.org/publications/more-more-more/ [Accessed 1 Nov. 2024].

TaxPayers’ Alliance. (2024). TaxPayers’ Alliance responds to Rachel Reeves’ budget. [online] Available at: https://www.taxpayersalliance.com/taxpayers_alliance_responds_to_rachel_reeves_budget [Accessed 1 Nov. 2024].